The following are the reasons why disparities may exist between the two. The bank fee is an expense (cost of doing business) and an expense is shown by an entry on the left side of a ledger (because it decreases our equity), meaning the checking account was decreased as well. Depending on the service or vendor that charged book balance vs bank balance your account, there may be a delay in their banking system connecting with yours. In this case, your bank will factor that charge into your overall account balance, and will mark the payment as ‘pending’, and give you an available balance. The majority of firms balance their books every month or every three months.

- The term book balance, which is also used in the bank reconciliation is the amount shown in the company’s general ledger for the bank account.

- Before looking for issues, make sure you haven’t listed the same entry twice or overlooked to record it in either column.

- When you record the reconciliation, you only record the change to the balance in your books.

- That is to say, the amount of the balance will be the same while it is on different sides of the ledger.

- Your statement contains the closing balance, the minimum payment due, and the available credit.

How confident are you in your long term financial plan?

For instance, if you haven’t reconciled your bank statements in six months, you’ll need to go back and check six months’ worth of line items. Whether this is a smart decision depends on the volume of transactions and your level of patience. For example, a restaurant or a busy retail store both process a lot of transactions and take in a lot of cash. They might reconcile on a daily basis to make sure everything matches and all cash receipts hit the bank account.

What is the statement balance?

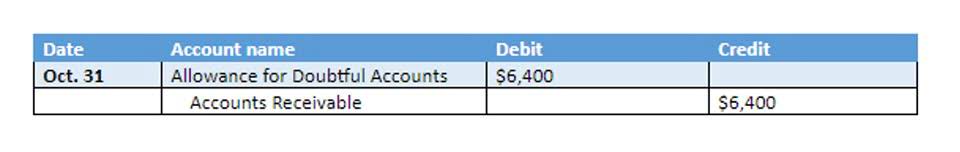

Usually, a staff member is not allowed to make journal entries or process transactions outside of his or her normal sphere of duties in order to prevent theft or mistakes. The difference between book and bank balance can come from many sources. This might be from outstanding checks, deposits in transit, errors, or even fraud. If you deposited a check, but it hasn’t been processed, your book balance will be higher than your bank balance. Due to mistakes in bank transactions that need to be fixed, the book balance and bank balance may occasionally change.

Total Balance

If the ledger balance is greater than the available balance, you can only spend up to the available balance. That is, the deposit and the bank card charge haven’t officially cleared. However, the available balance will be updated to reflect these changes.

- At the end of each month, the cash book is not balanced until a bank statement is received from the bank.

- You may consider keeping your own ledger, with a running total of your balance after considering any and all transactions through your account.

- Sending the statement directly limits the number of employees who would have an opportunity to tamper with the statement.

- Debits may include any transaction made throughout the day, such as bank card transactions.

- They may not be fun, but when you do them on a regular basis you protect yourself from all kinds of pitfalls, like overdrawing money and becoming a victim of fraud.

The cash sweep enables the business to make interest on its unused capital. The ledger balance isn’t updated until the end of the business day. The available balance is the ledger balance with pending transactions added or subtracted. These pending transactions can include checks, wire transfers, deposits, and bank card charges. As noted above, balances displayed on statements are taken from a ledger balance on the statement date.

You might overpay or underpay if you pay the current balance but not the statement balance. You’re better off referring to the minimum balance outlined in your statement so that you keep your account in good shape. For example, if your statement balance is $1,500 with a statement cycle 25 June to 25 July, any purchases after 25 July will still be owed. Refer to your current account balance to see your debt and budget accordingly.

It represents the existing balance on an account at the onset of the next business day. An account balance is the amount of money in a financial repository, such as a savings or checking account. An account balance is also evident on billing statements for credit cards, utilities, and loans. Reconciling bank balance and book balance is also key for financial planning and budgeting.

- Once you’ve done so, you’ll need basic math skills and a few minutes each day or month to verify the accuracy of your work and to calculate a running balance.

- It also gives transparency and accountability within an organization.

- Typically, book balance is used to manage the cash within a company’s checking account.

- The result would lead to a higher book balance than the bank balance.

- After viewing the ledger balance, if a check is written or a transaction is made, an account holder may withdraw more money than is available.

- You can only spend your available balance and not your ledger balance.

Bank reconciliations may be tedious, but the financial hygiene will pay off. It’s understated by $360 (divisible by 9) right now because of the recording error, and cash is overstated because we didn’t record the check correctly. We didn’t create a new account for the collection fee; we just used our existing bank fees account. However, if this kind of thing happened a lot, we might want to have a tracking account for those collection fees specifically. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Choose an account type that fits best with your lifestyle or business plan and commit to staying updated on your balance details, transaction history, and growing investment strategies.

What are the causes of disparities in balances per cash book and bank statement?

The account holder may, in many cases, learn of such a direct deposit only on receipt of their monthly statement. When David writes out a check, he makes an entry on the credit side of his cash book (being a reduction in asset, cash at bank). On the bank’s side, the record is usually kept in the form of a personal account. It is maintained more or less along the same lines as a businessperson maintains their personal accounts for debtors and creditors.